Amendment Made In Rates Of Tax Under Section 236C And 236K

Amendment Made In Rates Of Tax Under Section 236C And 236K

AMENDMENT MADE IN THE RATES OF TAX UNDER SECTIONS 236C & 236K

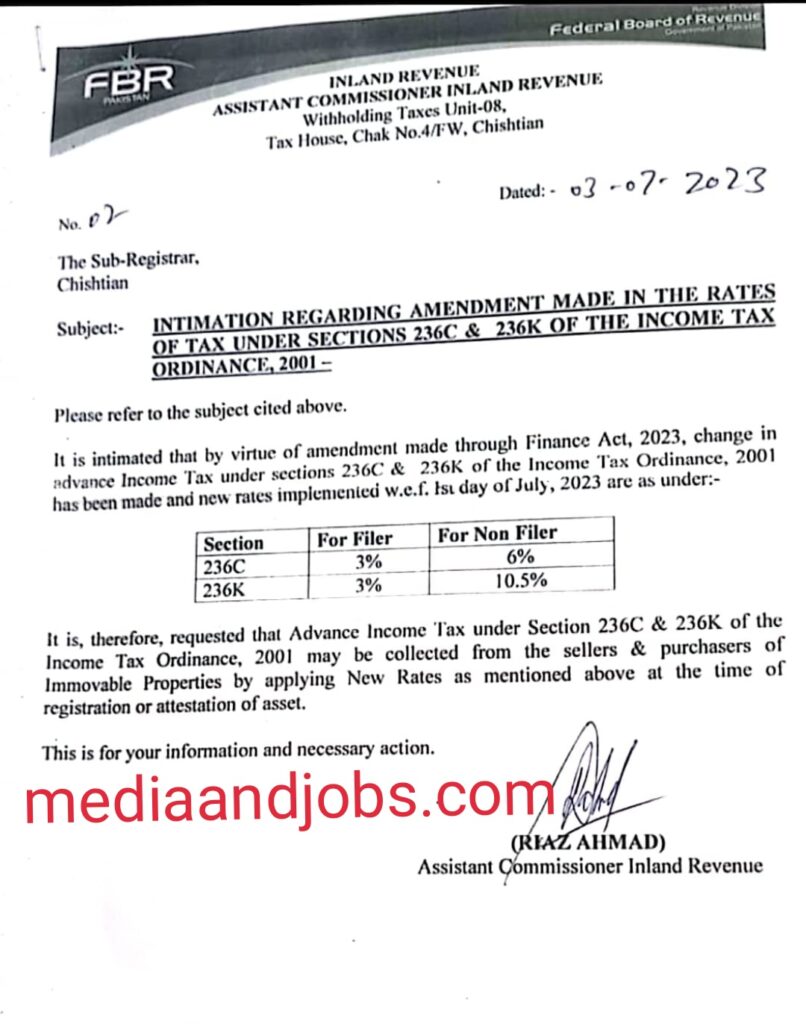

FBR PAKISTAN

INLAND REVENUE ASSISTANT COMMISSIONER INLAND REVENUE

Withholding Taxes Unit-08, Tax House, Chak No.4/FW, Chishtian

Subject : INTIMATION REGARDING AMENDMENT MADE IN THE RATES OF TAX UNDER SECTIONS 236C & 236K OF THE INCOME TAX ORDINANCE, 2001-

Please refer to the subject cited above. It is intimated that by virtue of amendment made through Finance Act, 2023, change in advance Income Tax under sections 236C & 236K of the Income Tax Ordinance, 2001 has been made and new rates implemented w.e.f. Ist day of July, 2023 are as under.

Section : 236C and 236K

For Filer

3%

3%

For Non Filer

6%

10.5%

It is, therefore, requested that Advance Income Tax under Section 236C & 236K of the Income Tax Ordinance, 2001 may be collected from the sellers & purchasers of

Immovable Properties by applying New Rates as mentioned above at the time of registration or attestation of asset. This is for your information and necessary action.

(RIAZ AHMAD)

Assistant Commissioner Inland Revenue

Dated:- 03-07- 2023

The Sub-Registrar, Chishtian

Federal Board of Revenue

Government of Pat

Join Us On :

Click Here To Get All Latest Government Jobs And Education News : https://mediaandjobs.com/

Join Our What’s app Group

https://chat.whatsapp.com/CVwROiD9kKSFwq6pnIdQxi

Click Here To Join Our Facebook Page To Get All Latest Government Jobs And Education News : https://www.facebook.com/profile.php?id=100085051735597&mibextid=ZbWKwL