Apni Chhat Apna Ghar Scheme: New Updates – November 2024

Apni Chhat Apna Ghar Scheme: New Updates – November 2024

Table Of Contents

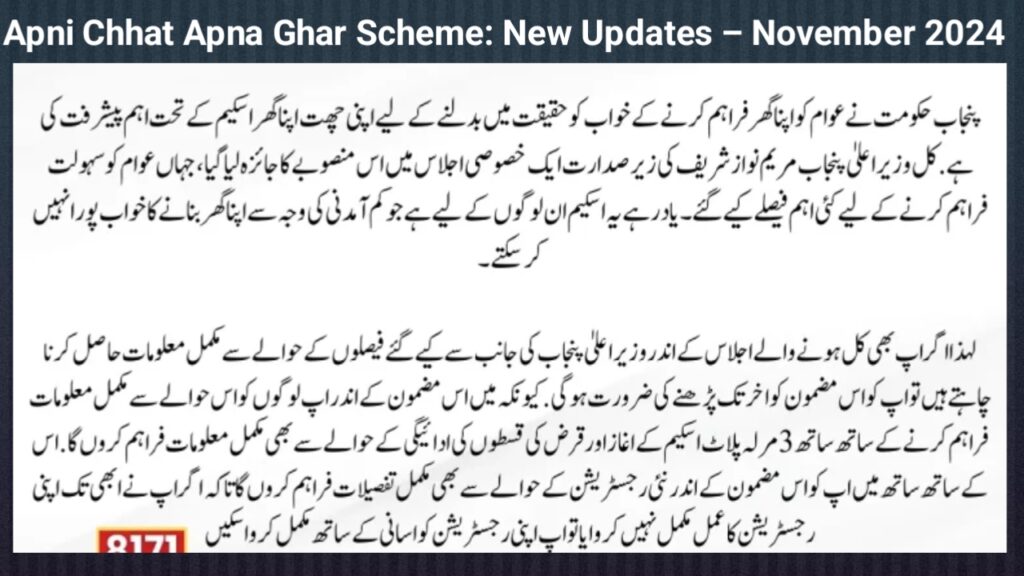

The Apni Chhat Apna Ghar Scheme is a government initiative in Pakistan aimed at making affordable housing accessible for low- and middle-income families. Launched to address the growing demand for housing, this scheme provides financial assistance, flexible loan options, and low-interest rates to help people buy or build their homes. With the latest updates in November 2024, the scheme has introduced several new provisions to simplify the application process, extend eligibility, and offer greater financial flexibility for families across the country.

Key Updates in Apni Chhat Apna Ghar Scheme – November 2024

- Extended Loan Limits: The scheme has increased the loan amount for low-income groups, allowing them to finance larger or higher-quality housing projects.

- Reduced Interest Rates: Interest rates have been lowered further to make loans more affordable and attractive.

- Expanded Eligibility: Eligibility criteria have been broadened, making the scheme accessible to more income groups, including lower-middle and middle-income families.

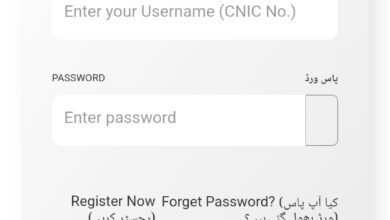

- Simplified Application Process: Digital application options and quicker processing times have been introduced to streamline the application process.

- Additional Subsidies: Higher subsidies are now available for applicants purchasing homes in underserved regions.

Benefits at a Glance

The following table summarizes the major benefits under the Apni Chhat Apna Ghar Scheme as of November 2024:

| Benefit | Description |

|---|---|

| Loan Amount | Up to PKR 5 million, depending on income bracket |

| Interest Rate | 3-5% for lower-income groups; market-based for others |

| Loan Tenure | Up to 20 years |

| Subsidy | Available for low-income and regional applicants |

| Application Processing Time | Reduced to 2-3 weeks |

| Repayment Flexibility | Flexible repayment schedules for low-income applicants |

Detailed Updates

- Increased Loan Amounts: Recognizing rising property prices, the scheme now offers higher loan amounts of up to PKR 5 million for eligible applicants. This change is expected to enable more families to afford better housing options.

- Lower Interest Rates: The government has further reduced interest rates, which now range from 3-5% for lower-income applicants, making monthly repayments more manageable.

- Broader Eligibility: Eligibility has been extended to include lower-middle and middle-income families. Now, families earning up to PKR 100,000 per month can apply for assistance.

- Quicker Application Processing: A revamped application process has cut down processing times, with approval expected within 2-3 weeks. Digital applications are encouraged for faster and more efficient processing.

- Regional Subsidies: Special subsidies and loan benefits are available for applicants purchasing homes in rural or underdeveloped regions, aiming to boost housing development in these areas.

Eligibility Criteria (as of November 2024)

- Nationality: Applicant must be a Pakistani citizen.

- Monthly Income: Families earning up to PKR 100,000 can qualify for reduced rates and subsidies.

- Age Limit: Applicants must be between 21 and 60 years old.

- First-Time Home Buyer: Priority is given to applicants who do not currently own property.

Frequently Asked Questions (FAQs)

- Who is eligible for the Apni Chhat Apna Ghar Scheme?

- Pakistani citizens aged 21-60 with a monthly income of up to PKR 100,000 are eligible. First-time home buyers receive priority.

- How much loan can I get under this scheme?

- Loan amounts vary by income bracket, with a maximum loan of up to PKR 5 million available.

- What interest rates are offered?

- Interest rates are set between 3-5% for low-income applicants, making loans affordable with manageable monthly payments.

- What is the application process for the scheme?

- Applicants can apply online through the scheme’s digital portal or through authorized bank branches. The process takes around 2-3 weeks for approval.

- Are there any special benefits for applicants in rural areas?

- Yes, special subsidies and financial support are available for applicants looking to buy or build homes in rural and underdeveloped areas.

- Can I use the loan for home renovation?

- The loan is primarily for purchasing or building new homes, though in some cases, partial funding for renovations may be considered.

Conclusion

The Apni Chhat Apna Ghar Scheme continues to be a crucial program for making homeownership affordable and accessible in Pakistan. With new updates in November 2024, including higher loan limits, lower interest rates, and expanded eligibility, the scheme has become even more inclusive and beneficial for a broader range of families. By simplifying the application process and providing regional subsidies, the government aims to help more Pakistanis fulfill their dream of owning a home. Whether you are a first-time homebuyer or looking to settle in an underserved area, the scheme offers a viable path toward securing stable and affordable housing.

Join Us On For Latest Updates For Click Here To Get All Latest Government Jobs And Education News : https://mediaandjobs.com/ You Can Join Our What’s app Grouphttps://chat.whatsapp.com/CVwROiD9kKSFwq6pnIdQxiClick Here To Join Our Facebook Page To Get All Latest Government Jobs And Education News : https://www.facebook.com/profile.php?id=100085051735597&mibextid=ZbWKwLDownload And Get Here all Data Of Your Requirement in One File https://heylink.me/EarnWithSSS/