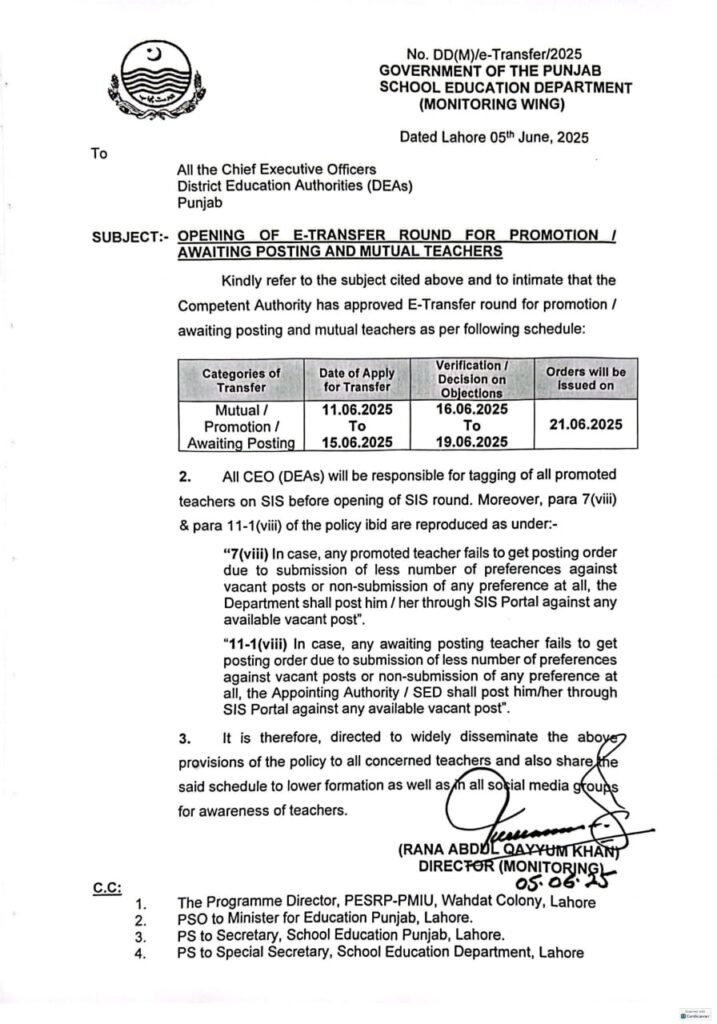

OPENING OF E TRANSFER

OPENING OF E TRANSFER

OPENING OF E TRANSFER

Table Of Contents

- 1 OPENING OF E TRANSFER

- 2 Outline

- 2.1 H1: Introduction

- 2.2 H2: Understanding E Transfer

- 2.3 H2: Types of E Transfers

- 2.4 H2: Opening an E Transfer Account

- 2.5 H2: Security in E Transfers

- 2.6 H2: Benefits of E Transfer

- 2.7 H2: Challenges in Opening E Transfer

- 2.8 H2: Legal and Regulatory Considerations

- 2.9 H2: Popular Platforms Offering E Transfer

- 2.10 H2: Tips for a Smooth E Transfer Setup

- 2.11 H2: Future of E Transfers

- 2.12 H2: Conclusion

- 2.13 H2: FAQs

- 3 Opening of E Transfer

- 3.1 Introduction

- 3.2 Understanding E Transfer

- 3.3 Types of E Transfers

- 3.4 Opening an E Transfer Account

- 3.5 Security in E Transfers

- 3.6 Benefits of E Transfer

- 3.7 Challenges in Opening E Transfer

- 3.8 Legal and Regulatory Considerations

- 3.9 Popular Platforms Offering E Transfer

- 3.10 Tips for a Smooth E Transfer Setup

- 3.11 Future of E Transfers

- 3.12 Conclusion

- 3.13 FAQs

Outline

H1: Introduction

- What is E Transfer?

- Why the Opening of E Transfer is Important?

H2: Understanding E Transfer

- H3: Definition of Electronic Transfer

- H3: History and Evolution of E Transfer

- H3: Difference Between Traditional Transfer and E Transfer

H2: Types of E Transfers

- H3: Bank-to-Bank Transfers

- H3: Mobile Payment Transfers

- H3: International Money Transfers

- H3: Peer-to-Peer (P2P) Transfers

H2: Opening an E Transfer Account

- H3: Requirements to Open an E Transfer Account

- H3: Step-by-Step Process to Open E Transfer Service

- H4: Choosing a Service Provider

- H4: Verifying Your Identity

- H4: Linking Bank Accounts or Cards

- H4: Setting Up Security Measures

H2: Security in E Transfers

- H3: Encryption & Authentication

- H3: Best Practices to Stay Safe

H2: Benefits of E Transfer

- H3: Speed and Convenience

- H3: Reduced Transaction Costs

- H3: Accessible 24/7

H2: Challenges in Opening E Transfer

- H3: Technical Barriers

- H3: Identity Verification Issues

- H3: Regional Limitations

H2: Legal and Regulatory Considerations

- H3: Compliance Requirements

- H3: KYC & AML Laws

- H3: Government Regulations in Different Countries

H2: Popular Platforms Offering E Transfer

- H3: PayPal

- H3: Venmo

- H3: Wise (formerly TransferWise)

- H3: Google Pay / Apple Pay

H2: Tips for a Smooth E Transfer Setup

- H3: Common Mistakes to Avoid

- H3: Choosing the Right Provider for Your Needs

H2: Future of E Transfers

- H3: Role of AI and Blockchain

- H3: Trends to Watch

H2: Conclusion

H2: FAQs

- H3: What documents are needed to open an E Transfer account?

- H3: Is E Transfer available in all countries?

- H3: How long does it take to activate an E Transfer service?

- H3: Are E Transfers safe for large amounts?

- H3: Can I cancel an E Transfer once initiated?

Opening of E Transfer

Introduction

Let’s face it — gone are the days of standing in long lines at the bank just to send money. With everything going digital, E Transfer has become the new normal. Whether you’re paying a friend back for coffee or transferring rent across continents, e transfers are fast, easy, and super convenient. But what exactly goes into opening an E Transfer service? And why should you care? That’s exactly what we’ll uncover in this guide.

Understanding E Transfer

Definition of Electronic Transfer

An Electronic Transfer (or E Transfer) is the digital movement of money from one bank account or platform to another without any physical exchange of cash. Think of it as digital teleportation — for your money.

History and Evolution of E Transfer

E Transfers have evolved from telegraph-based money transfers to sophisticated mobile apps. From Western Union in the 1800s to instant payments today, we’ve come a long way!

Difference Between Traditional Transfer and E Transfer

While traditional transfers often involve paper forms, waiting periods, and manual verification, E Transfers are typically instant, automated, and can be done from the comfort of your couch.

Types of E Transfers

Bank-to-Bank Transfers

This is the classic method, involving online banking portals. Whether you’re transferring to your savings account or paying bills, it’s reliable and secure.

Mobile Payment Transfers

Apps like Zelle, Google Pay, and Apple Pay let you transfer money in a snap. Great for splitting dinner bills or paying for a quick service.

International Money Transfers

Platforms like Wise and Western Union enable fast and cheap cross-border transfers with transparent currency conversions.

Peer-to-Peer (P2P) Transfers

These allow individuals to send money directly to each other. No middlemen, no fuss.

Opening an E Transfer Account

Requirements to Open an E Transfer Account

Before you dive in, you’ll need:

- A valid ID (passport, driver’s license, etc.)

- An active email address

- A working mobile number

- A linked bank account or credit/debit card

Step-by-Step Process to Open E Transfer Service

1. Choosing a Service Provider

First things first — pick your platform. Are you using PayPal, Venmo, or your bank’s native service? Compare fees, security, and usability.

2. Verifying Your Identity

Almost every service will ask for ID verification. This keeps things secure and compliant with international regulations.

3. Linking Bank Accounts or Cards

You’ll need to connect your financial source — usually your primary bank account or a credit card.

4. Setting Up Security Measures

Don’t skip this. Enable 2-factor authentication (2FA), choose strong passwords, and activate email or SMS alerts.

Security in E Transfers

Encryption & Authentication

Your data is encrypted end-to-end. This means it’s scrambled and unreadable to hackers. Authentication layers like OTPs and biometric scans add extra safety.

Best Practices to Stay Safe

- Never share your login credentials

- Use only trusted Wi-Fi networks

- Always double-check recipient info

Benefits of E Transfer

Speed and Convenience

No need to wait 3-5 business days. Most e transfers happen within seconds or minutes.

Reduced Transaction Costs

Some platforms offer free transfers within networks. Even international fees are dropping, thanks to fintech innovations.

Accessible 24/7

Middle of the night? Weekend? Holiday? Doesn’t matter — E Transfers work round the clock.

Challenges in Opening E Transfer

Technical Barriers

Some people still struggle with apps and interfaces, especially older adults or those without smartphones.

Identity Verification Issues

Mismatch of documents, expired IDs, or regional restrictions can delay or block account creation.

Regional Limitations

Not all services are available globally. Some countries restrict certain platforms due to local laws.

Legal and Regulatory Considerations

Compliance Requirements

Services must comply with international anti-money laundering (AML) laws and financial regulations.

KYC & AML Laws

Know Your Customer (KYC) laws require verification of identity to prevent illegal activities.

Government Regulations in Different Countries

Each country has its own take on digital money transfers. Be sure to read the fine print for your region.

Popular Platforms Offering E Transfer

PayPal

One of the oldest and most trusted platforms. Widely accepted globally.

Venmo

A U.S.-focused app that makes transferring money almost feel like social media.

Wise (formerly TransferWise)

Great for international users. Low fees, transparent rates.

Google Pay / Apple Pay

Perfect for quick transfers and even contactless payments at stores.

Tips for a Smooth E Transfer Setup

Common Mistakes to Avoid

- Using mismatched names on bank accounts

- Forgetting to verify emails or phone numbers

- Ignoring security updates

Choosing the Right Provider for Your Needs

If you transfer money frequently across countries, go for Wise. For daily payments, Venmo or Cash App might work better.

Future of E Transfers

Role of AI and Blockchain

Artificial Intelligence is helping detect fraud in real time. Blockchain tech could soon enable decentralized, instant, and ultra-secure transfers.

Trends to Watch

- Integration with wearable tech

- Crypto-based transfers

- Voice-command transactions

Conclusion

Opening an E Transfer account is no longer a complex or intimidating process. It’s actually one of the easiest and most rewarding financial steps you can take in our digital-first world. Whether you’re a freelancer receiving international payments, a student sending money home, or just someone who wants to avoid the ATM, the future is clear — and it’s paperless. So, if you haven’t set up your E Transfer service yet, now’s the perfect time. Embrace convenience, speed, and control over your finances.

FAQs

1. What documents are needed to open an E Transfer account?

Usually, a government-issued ID, a valid email, and a linked bank account are required.

2. Is E Transfer available in all countries?

No, availability depends on regional regulations and platform restrictions.

3. How long does it take to activate an E Transfer service?

It typically takes a few minutes to a few hours, depending on verification steps.

4. Are E Transfers safe for large amounts?

Yes, as long as you use secure platforms with encryption and authentication.

5. Can I cancel an E Transfer once initiated?

It depends on the service. Some allow cancellations if the recipient hasn’t accepted the transfer yet.

Join Us On For Latest Updates For Click Here To Get All Latest Government Jobs And Education News : https://mediaandjobs.com/You Can Join Our What’s app Grouphttps://chat.whatsapp.com/CVwROiD9kKSFwq6pnIdQxiClick Here To Join Our Facebook Page To Get All Latest Government Jobs And Education News : https://www.facebook.com/profile.php?id=100085051735597&mibextid=ZbWKwLDownload And Get Here all Data Of Your Requirement in One File https://heylink.me/EarnWithSSS/