New Income Tax Rates For Government Employees 2023-2024

New Income Tax Rates For Government Employees 2023-2024

Income Tax Rates According To Finance Act 2023

Table Of Contents

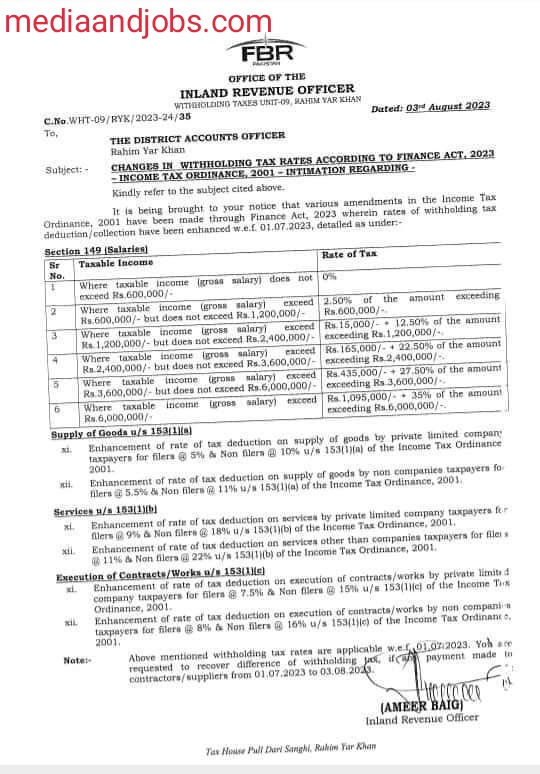

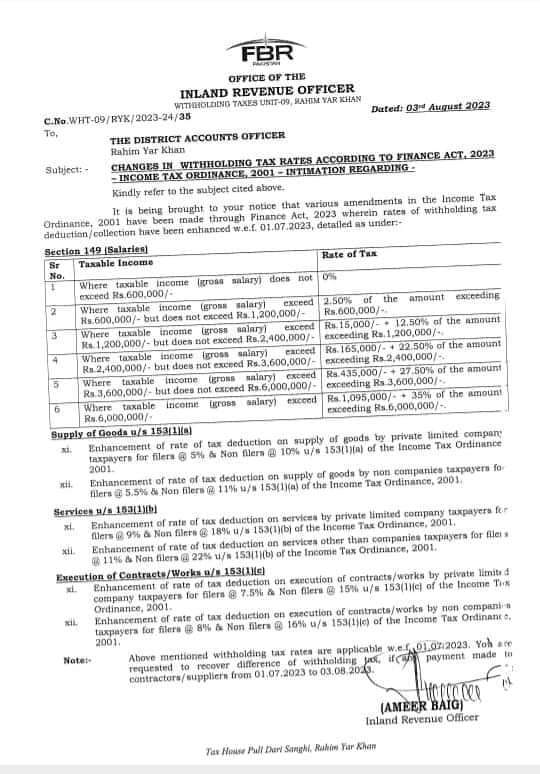

OFFICE OF THE INLAND REVENUE OFFICER WITHHOLDING TAKES UNIT-09, HAHIM YAR KHAN THE DISTRICT ACCOUNTS OFFICER Rahim Yar Khan Dated: 03 August 2023

Subject: CHANGES IN WITHHOLD1ING TAX RATES ACCORDING TO FINANCE ACT, 2023

-INCOME TAX ORDINANCE 2001-INTIMATION REGARDING

Kindly refer to the subject cited above. It is being brought to your notice that various amendments in the Income Tax Ordinance, 2001 have been made through Finance Act, 2023 wherein rates of withholding tax deduction/collection have been enhanced w.e.f. 01.07.2023, detailed as under.

Tax Rates Based on Taxable Income

| Taxable Income Range | Tax Rate |

|---|---|

| Up to Rs. 600,000 | 0% |

| Rs. 600,001 to Rs. 1,200,000 | 2.5% on the excess |

| Rs. 1,200,001 to Rs. 2,400,000 | Rs. 15,000 + 12.5% on the excess |

| Rs. 2,400,001 to Rs. 3,600,000 | Rs. 165,000 + 22.5% on the excess |

| Rs. 3,600,001 to Rs. 6,000,000 | Rs. 435,000 + 27.5% on the excess |

| Rs. 6,000,001 to Rs. 12,000,000 | Rs. 1,095,000 + 35% on the excess |

| Above Rs. 12,000,000 | Rs. 2,955,000 + 35% on the excess |

Supply of Goods u/s 153(1)(a)

xi. Enhancement of rate of tax deduction an supply of goods by private limited compan taxpayers for filers @ 5% & Non fillers @10% u/s 153(1)(a) of the Income Tax Ordinance

2001.

xii. Enhancement of rate of tax deduction on supply of goods by non companies taxpayers fo filers @ 5.5% & Non filers @ 11% a/s 153(1)(a) of the Income Tax Ordinance, 2001.

Services u/s 153(1)(b)

xi. Enhancement of rate of tax deduction on services by private limited company taxpayers for fillers 9% & Non filers @18% u/s 153(1)(b) of the Income Tax Ordinance, 2001.

xii. Enhancement of rate of tax deduction an services other than companies taxpayers for files 11% & Non filers @22% u/s 153(1)(b) of the Income Tax Ordinance, 2001.

Execution of Contracts/Works u/s 153(1)(c)

xi. Enhancement of rate of tax deduction on execution of contracts/works by private limited company taxpayers for filers@7.5% & Non filera @ 15% u/s 153(1c) of the Income Tox Ordinance, 2001.

xii. Enhancement of rate of tax deduction on execution of contracts/works by non companies taxpayers for filers @ 8% & Non filers @ 16% u/s 153(1jle) of the Income Tax Ordinance.

2001.

Note :

Above mentioned withholding tax rates are applicable wef 01.07.2023. Yoh are requested to recover difference of withholding Ja, if payment made to

contractors/suppliers from 01.07.2023 to 03.08.2023.

(AMEER BAIG)

Inland Revenue Officer

Tax House Pull Dari Sanghi, Rahim Yar Khan

Official Notification

Here To Get All Latest Government Jobs And Education News : https://mediaandjobs.com/

Join Our What’s app Group

https://chat.whatsapp.com/CVwROiD9kKSFwq6pnIdQxi

Click Here To Join Our Facebook Page To Get All Latest Government Jobs And Education News : https://www.facebook.com/profile.php?id=100085051735597&mibextid=ZbWKwL